Customs Declarations Services

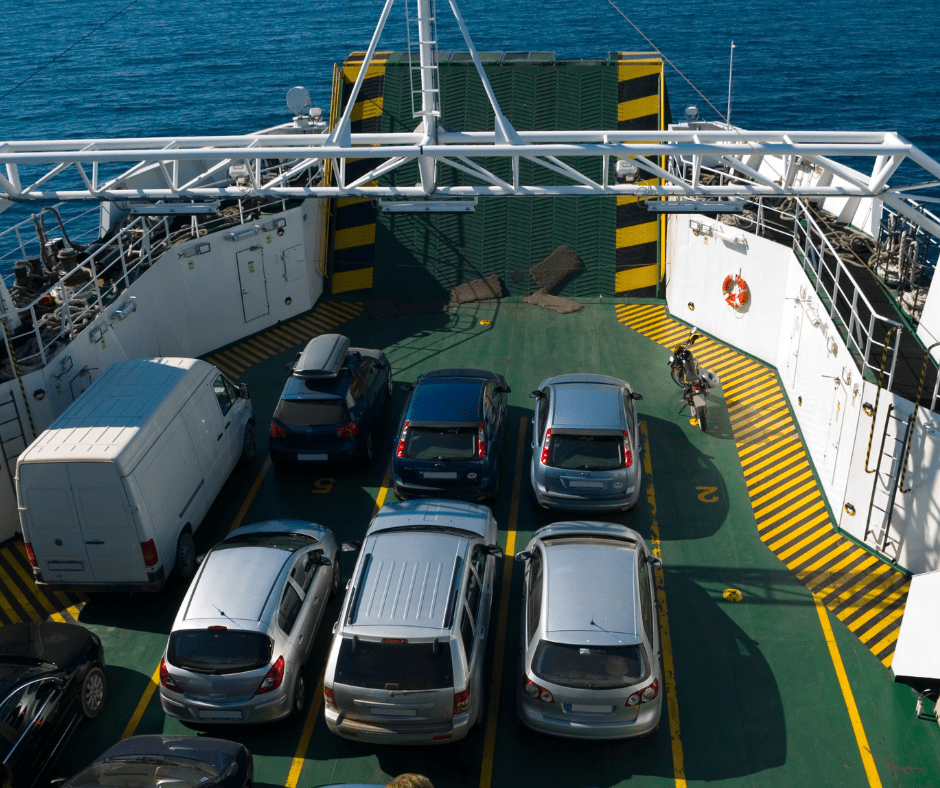

The importation of a vehicle from the UK is now treated as an import from a non-European Union (EU) country. When importing a vehicle you will now be required to (i) Complete a customs declaration, (ii)Pay or account for customs duty, if applicable, (iii)Pay VAT at 23%, (iv)Pay VRT. You are required to complete a customs declaration and clear customs when your vehicle enters the state from outside the EU. If you do not have a customs declaration and are stopped by customs at the port when you arrive in Ireland, customs may prevent the vehicle from leaving the port until a customs declaration is completed and the vehicle has cleared customs.All vehicles imported from outside the EU require a customs declaration. At Independent Customs & Logistics we have completed customs declarations for cars, vans, trucks, HGVs, tractors, motorcycles, caravans, camper vans, classic vehicles, boats and other goods. As part of the customs declaration process you may be required to pay customs duty. This is generally determined based on the country of origin of the vehicle and the type of vehicle. Vehicle origin typically means where the vehicle was manufactured not where you are importing the vehicle from. UK-origin cars imported from the UK are subject to 0% customs duty. EU (e.g. German manufactured vehicles) origin cars imported from the UK are subject to 10% customs duty.Contact us today if you need our help clearing customs

Vehicle Registration (VRT)

VRT: When importing a car into Ireland – buyers need to be aware that VRT (Vehicle Registration Tax) also has to be paid The VRT is calculated on the Revenue’s assessment of the car’s “open market selling price ” (OMPS) in Ireland rather than its UK price. VRT is calculated as a percentage of the OMPS – with lower CO2 emission cars having a lower rate of VRT.

You can get an estimate of the VRT to be paid on an imported car here

Ensuring Compliance

Customs services are essential for every business and at ICLS we familiarise ourselves with your company to provide a tailor made service for your business.

We have worked with companies for over 30 years and we have an expert knowledge, experience and a dedicated professional team who can ensure compliance saving you time and money and giving you time to work on your core business

We would include areas to focus on:

- Securing beneficial classifications and duty rates

- Reviewing entitlement to preferential and non-preferential

- Origin

- Advice and negotiations on customs valuation

- Advising on and securing duty reliefs

- Centralised Clearance and SASP

- Audits and Investigations

- Excise Consultancy

- Security and Supply Chain

- Managed Customs Clearance

- Trade and compliance

- Export management

- Trade Issues

- Export Licensing

Our team is dedicated to your business requirements.

Get in Touch